Bitcoin liquidations have been ramping up over the last day following the market crash that rocked the crypto space on Thursday. The result of this is a liquidation event, the likes of which have not been seen since the FTX collapse back in 2022. And Bitcoin’s numbers have shot up as long traders are completely obliterated in the process.

Largest Single Crypto Liquidation Event In 2023

Following Bitcoin’s price decline to the low $25,000s, the liquidations picked up quickly with over $1 billion dollars of crypto positions being closed rapidly. Bitcoin, in particular, suffered the brunt of these liquidations as its numbers quickly climbed to 9 digits.

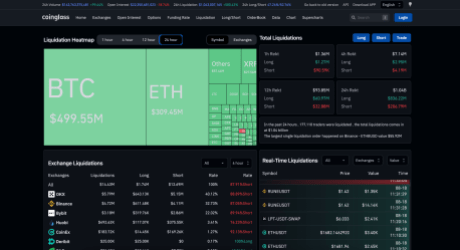

By the time Friday morning rolled around, the digital asset’s liquidation was at approximately $500 million with long traders suffering the majority of losses. According to data from Coinglass, Bitcoin’s long liquidation figures were already over $373 million, with shorts coming in at $125 million.

BTC liquidations almost at $500 million | Source: Coinglass

While Bitcoin was in the lead as expected, Ethereum was not that far behind. The second-largest cryptocurrency by market cap saw an even larger proportion of long liquidations compared to shorts. Out of the $308 million in liquidations, long traders lost $254.59 million while short traders came in at $54.3 million.

Ethereum also saw the largest single liquidation order. The order which was worth $55.92 million at the time took place on the Binance crypto exchange across the ETH/BUSD pair. However, the OKX exchange saw the largest Ethereum liquidations at $108.87 million, 92.8% of which were longs.

The Tide Is Starting To Turn For Bitcoin

Following the initial plummet, Bitcoin began to show strength which saw its price add over $1,000. This recovery to $26,000 signaled a possible turn for the digital assets and the shorters began to feel the heat at this point.

In the last four hours, long traders have gotten some reprieve as $8.53 million of the $10.96 million in liquidations so far were short trades. However, long traders are still not left out with $2.46 million in liquidations as well.

Since the Bitcoin price remains extremely volatile at this point, liquidation volumes are expected to rise. However, there is no indication so far of where the price of the digital asset might be headed next as bulls and bears continue a tug-of-war for control.

Bitcoin is currently trading at a price of 26,451, representing a price decline of 7.48% over the last day, according to data from Coinmarketcap. The asset has also seen a 110% increase in daily trading volume which is now sitting at $34.47 billion.

BTC price falls from $29,000 to $25,000 | Source: BTCUSD on TradingView.com