- Shanghai Composite Index records a single-day gain of 8%, reflecting restored investor confidence and reversing previous losses.

- Speculative traders shift from Bitcoin to Chinese equities, seeking higher returns amid increased market volatility.

Recent fiscal and monetary stimulus measures implemented by China have had noticeable effects on the financial markets, both domestically and globally. The People’s Bank of China has injected liquidity into the financial system, reduced the reserve requirement ratios by 0.2%, and cut mortgage rates.

These actions aim to stabilize the economy by supporting the stock and real estate markets.

A report from 10x Research outlines that the Chinese government’ capital injections and reduced borrowing costs have contributed to a robust performance in the Chinese stock markets.

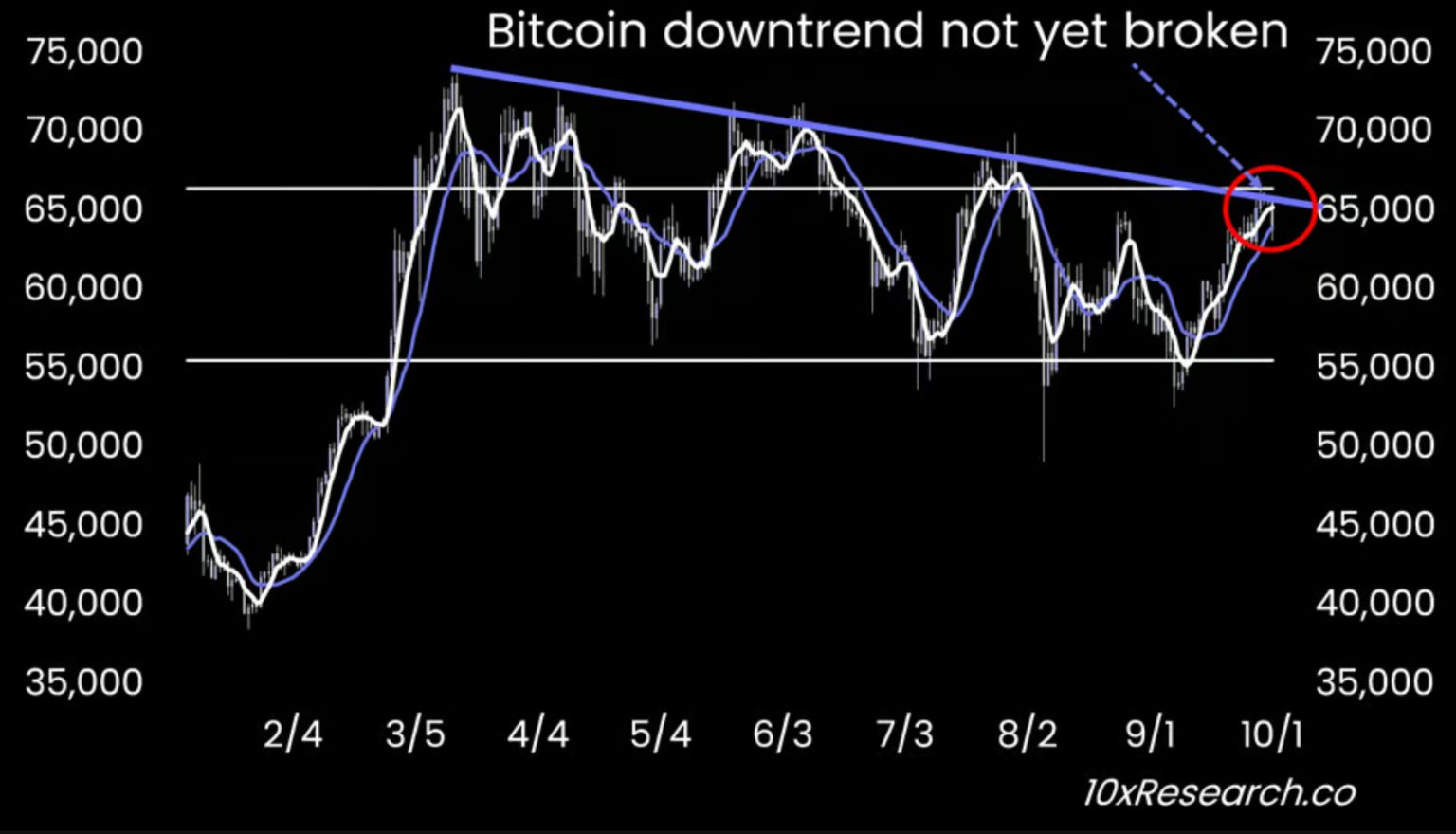

Are #Bitcoin Traders’ Short-Term Concerns Justified? Yes but…

Analyzing the Key Factors That Could Significantly Impact Bitcoin’s Price in the Coming Weeks.

?1-10) The crypto market is undergoing some significant shifts. While short-term concerns have been evident, larger… pic.twitter.com/TzkoLDFTrk

— 10x Research (@10x_Research) October 1, 2024

The Shanghai Composite Index, for example, surged 8% on the last trading day before the National Day holiday, marking the largest single-day gain since 2008. This surge capped a month where the index rose by 17%, reversing previous losses and restoring investor confidence.

However, the report also indicates concerns about whether these measures will be sufficient to sustain long-term growth in the world’s second-largest economy. China, as a major global manufacturing hub and the top consumer of raw materials, has an influence on global markets.

Any economic instability in China can have ripple effects worldwide

These economic adjustments have influenced trading behaviors. Speculative traders are reportedly shifting their investments from Bitcoin to Chinese equities, attracted by the potential for higher returns given the increased market volatility.

This shift is partly due to Bitcoin’s current technical indicators, which suggest it is overbought, potentially leading to a price correction.

Additionally, the latest economic data from China, including Purchasing Managers’ Index (PMI) figures, indicate a contraction in manufacturing activities for the fifth consecutive month, with the non-manufacturing PMI also showing signs of decline. This data suggests that further economic stimuli might be necessary to prevent a deeper downturn.

The outcomes of China’s economic policies could significantly influence global economic performance and investor strategies in the coming months.