Hello and welcome to the latest edition of the FT’s Cryptofinance newsletter.

“The Times 03/Jan/2009: Chancellor on brink of second bailout for banks.”

In the early days of 2009, bitcoin’s pseudonymous creator Satoshi Nakamoto etched that headline into the first batch of bitcoin transactions ever processed.

The message was a nod to bitcoin’s intended purpose, as laid down in the initial white paper: a form of electronic cash that offered people the chance to separate their financial lives from the control of powerful intermediaries such as banks, regulators or the government.

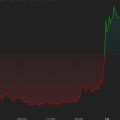

Crypto’s confident, scornful and punky start came to mind this week for some when bitcoin surged to roughly $35,000. It was a small but meaningful moment: all those losses sustained after the Terra stablecoin collapsed and sent a whole heap of trouble pulsing through the market were erased.

But what triggered the gains was, well, nothing very much.

The market is on tenterhooks so much because BlackRock, the world’s largest asset manager, may soon receive regulatory approval in the US to launch a cash bitcoin exchange traded fund, something that invests directly in bitcoin and can be traded as easily on the New York Stock Exchange as Apple.

But this has been the case for months and the approvals may not come until next year. What seemed to have got bitcoin enthusiasts excited was BlackRock’s ETF added to a list of eligible assets that are held at the US securities clearing house.

This is the equivalent of a harried waiter in a crowded restaurant clearing a table, before ushering you over; a necessary step but it doesn’t mean you’re going to eat imminently.

Nor was the spike an isolated incident. Last week bitcoin leapt 8 per cent on a false rumour that BlackRock had indeed secured regulatory approval.

The assumption is that approval will inspire a new wave of inflows into a market that has long struggled with next to no liquidity.

As Jeremy Senderowicz of law firm Vedder Price told me: “To have an ETF launch necessarily represents the maturation of an asset class: it’s a sign that it has arrived in the format that anyone can access?.?.?.?you would think that could only be a good thing for crypto.”

But good news for Wall Street’s crypto-curious is not being welcomed everywhere. Crypto’s longtime believers, who have followed bitcoin’s development since the early days, tell me a financial revolution is being traded in for a spot on Wall Street.

“It’s a maddening betrayal of crypto’s foundational principles, a sellout to traditional finance and a surrender of our ideals,” said Charles Storry, head of growth at crypto index platform Phuture.

“Satoshi Nakamoto’s vision of a permissionless liberation from government now lies in the hands of the world’s largest establishment, asking America’s regulators to approve something that makes bitcoin just like any other asset class,” he added.

Some still fight the good fight. Last month Erik Voorhees, founder of crypto platform ShapeShift and ardent crypto-libertarian, tried to rally the faithful:

“Before crypto, all movement of funds required someone’s permission?.?.?.?try moving ten thousand dollars across a border and you’ll be swiftly reminded of the permissions that are imposed on you?.?.?.?so thank God a permissionless form of money was invented.”

But the excitement around BlackRock illustrates how the narrative on crypto has moved on as the reality of life intrudes. There is an argument that crypto should take what it can get: ETF approvals would be rare wins for a world whose former figurehead is on trial for fraud in New York, and whose biggest surviving companies are facing lawsuits for violating securities laws and illegally accessing US customers.

It’s also easy to imagine that a successful BlackRock application would send the price of bitcoin flying.

“A BlackRock approval can open the tap for a lot of wealth managers and asset managers to take even a small position on bitcoin, it can potentially be a game-changer,” added Javier Rodriguez-Alarcon, chief commercial officer at XBTO, a digital assets platform.

But not even a potential bull run for bitcoin can shake off the sense of capitulation for the industry’s die-hards.

Only El Salvador and the Central African Republic adopted bitcoin as legal tender, nor did it really bank the unbanked, or seriously provide a financial lifeline to those living under an authoritarian regime.

Instead Wall Street has executed its own takeover. Satoshi envisaged a unfluctuating world, where records are immutable and there are a finite number of bitcoins, 21mn. An ETF is a securitised version of bitcoin but it can be replicated, scaled and traded to match demand.

As Matthew Cloete, head of marketing at Ryze, a London crypto trading firm, notes:

“Most people think that the ETF is going to be the catalyst for the next bull market, which just goes to show how far we have strayed from the original vision, almost as if we’re throwing in the towel.”

What’s your take on crypto’s hopes for a BlackRock ETF? As always, email me at scott.chipolina@ft.com.

FTX trial latest

The trial of Sam Bankman-Fried took another turn when the disgraced former FTX kingpin decided he would testify in his own defence.

Defence lawyers don’t usually advise this course of action to clients but observers say the prosecution has put forward a powerful case. Plus, it’s no surprise to anyone who has followed Bankman-Fried closely that he would want to tell his version of events.

Bankman-Fried’s defence got off to an unusual start: the judge sent the jury home while he decided what evidence can be repeated in front of jurors when they return today.

His lawyers have already publicly laid out the plan: SBF was following legal advice in many of his actions and lawyers help draft many of the policies, such as data retention (or lack of it) and how customer money intended for FTX ended up in his Alameda Research trading arm.

Soundbite of the week: Senator Lummis turns up the heat

The wind has changed direction on crypto in Washington after Hamas’s attack on Israel this month. Last week, I reported that Israeli law enforcement authorities ordered the closure of more than 100 Binance accounts, and Tether had frozen 32 addresses linked to “terrorism and warfare” in Israel and Ukraine.

Now senator Cynthia Lummis and representative French Hill have urged the Department of Justice to speed up investigations into crypto’s two largest players: the Binance exchange and Tether, the stablecoin provider.

“We urge the Department of Justice to carefully evaluate the extent to which Binance and Tether are providing material support and resources to support terrorism through violations of applicable sanctions laws and the Bank Secrecy Act. To that end, we strongly support swift action by the Department of Justice against Binance and Tether to choke off sources of funding to the terrorists currently targeting Israel.”

Data mining: A final word on BlackRock and bitcoin

The importance of the US regulator to a bitcoin ETF approval is underscored by location of bitcoin assets under management. The US is far ahead of the rest of the world, as figures from CCData show. Moreover the total value of bitcoin under management has increased by almost $3bn this month, to the highest point since June.

FT Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.