An EIGEN whale is accumulating days after Justin Sun dumped the token moments after EigenLayer announced the highly anticipated unlocking event

Crypto holders are in a difficult spot, at least looking at trends over the past day.

Despite a solid September, Bitcoin, EigenLayer (EIGEN), Ethereum, and other altcoins are in red.

To put the numbers in perspective, Ethereum is down 15% from September highs, while the October start marks one of the worst for Bitcoin in at least ten years.

There is hope, nonetheless. The selling pressure from Bitcoin miners is waning, and there are mixed transfers. Amid this, some ETH whales are also accumulating at spot rates.

Meanwhile, buyers appear to be back in the equation for EIGEN, the native layer for EigenLayer.

EigenLayer Falls, Down 23% But One Whale Is Actively Buying

After the highly-anticipated unlocking of EIGEN on September 30 and the trading on October 1, prices are steadying.

EIGEN is down 23% from the recent swing high, looking at OKX data.

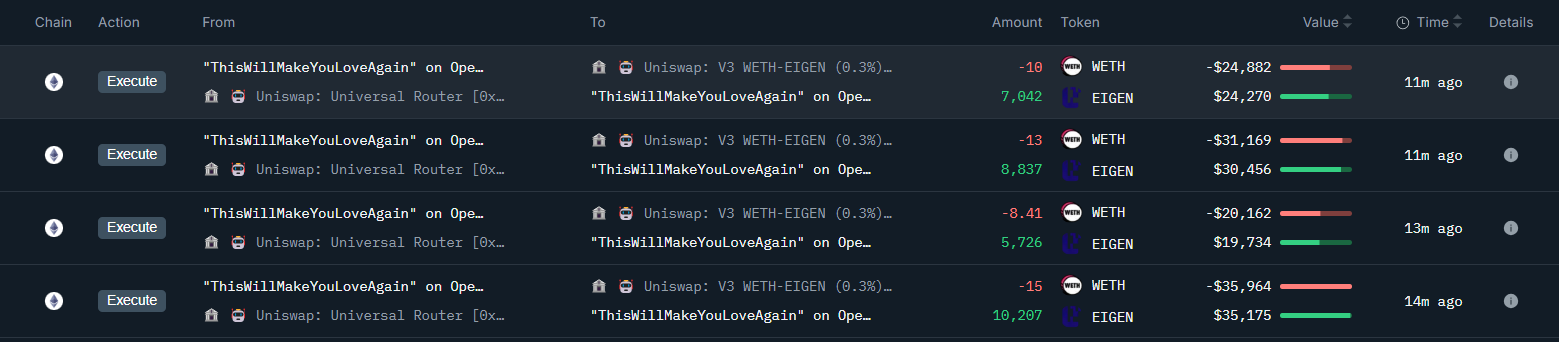

However, it looks like one trader thinks EIGEN is undervalued and has begun accumulating, according to data shared by one analyst.

In a post on X, the whale bought 31,812 EIGEN for 46.41 ETH, on October 3.

(Source)

The purchase, per the EIGENUSDT price action, is when the token bounced, adding 12% from the recent all-time low.

It remains to be seen whether EIGEN will shake off the recent wave of selling pressure and soar, breaking above October 1 highs.

Hours after the unlocking, Justin Sun, the co-founder of Tron, cashed out, sending his stash to Binance.

Trackers showed that Sun sold 5.37 million EIGEN at an average price of $4.03, netting over $21 million from the free tokens received from the stakedrops.

(Source)

After selling, he sent USDT to Aave v3, a decentralized money market protocol on Ethereum.

How EIGEN performs in the coming days depends largely on whether EigenLayer will achieve its mission.

DISCOVER: Could These ICOs Be The Fastest Way to 100X Your Portfolio in 2024?

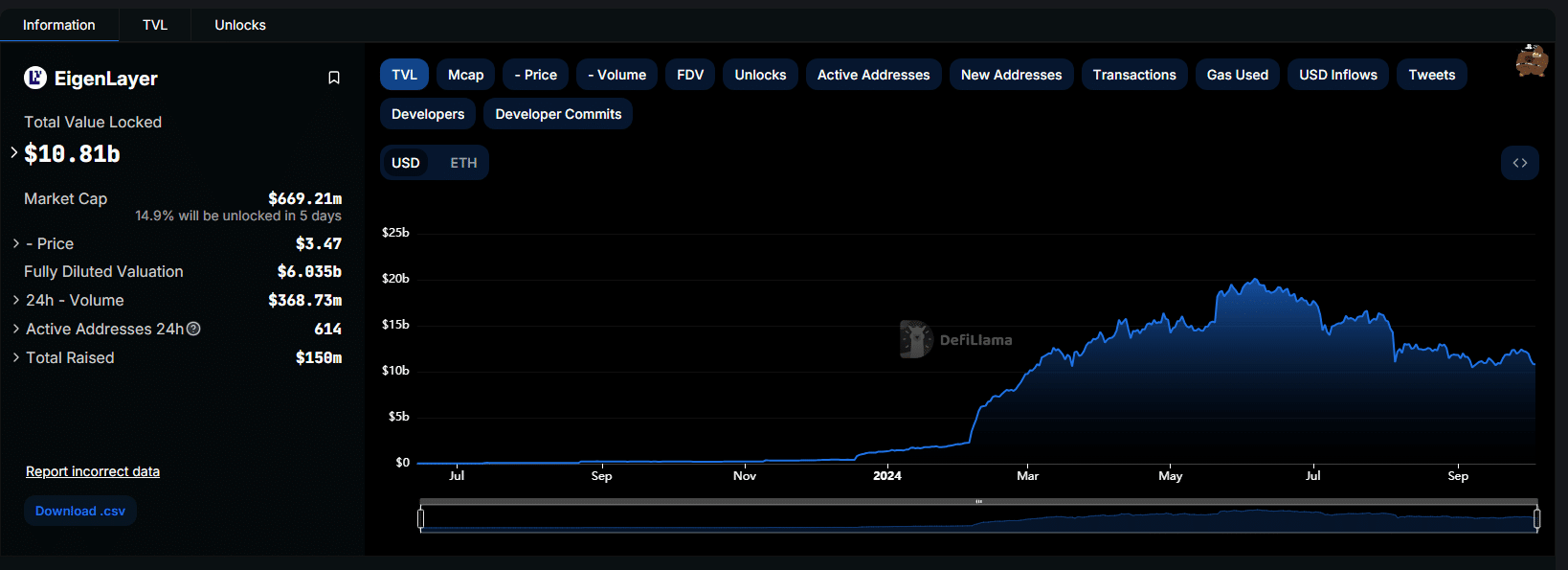

EigenLayer TVL At Over $10.8 Billion, Will AVS Boost Growth?

EigenLayer is a liquidity re-staking platform on Ethereum.

According to DeFiLlama, the protocol manages over $10.8 billion, making it the third largest DeFi solution after Lido and Aave.

(Source)

Despite the billions, asset inflows have slowed down. In the past week, they have been down nearly 13% and 6% in 24 hours.

As of October 4, there are 618 active addresses linked to EigenLayer, which has cumulatively generated $2,025 in gas fees over the past day.

With tokens in circulation, EigenLayer said the unlock now presents opportunities for developers to build Actively Validated Services (AVSs) via EIGEN staking. In turn, the AVS will help boost growth in the re-staking platform.

EXPLORE: Mbappe Themed Mpeppe Coin Goes Viral: But New Pepe Layer-2 is Aiming to Be Top Frog

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.