It’s been a sobering month for crypto. King of the nerds Sam Bankman-Fried was found guilty on all charges relating to the rapid rise and fall of FTX and is likely to face decades in prison. His arrest for running the biggest corporate fraud in US history has shaken crypto bros out of their Wild West behaviours and forced them to clamour for regulation and transparency.

But one corner of the crypto industry isn’t ready to straighten up.

Crypto ATMs are a niche but still growing area, despite whack-a-mole efforts by regulators to shut them down for being the ideal way to launder money. Operators say they help ordinary people convert fiat (real) money into and out of their crypto wallets, much like a normal cash point does with a normal bank account.

One operator of machines across Europe, the aptly named Shitcoins Club, says it helps people in “bypassing the banking system”. To better understand their business model we contacted Shitcoins Club, but were told: “our company’s focus and client base do not align well with the interests of your readership, which primarily represents the traditional fiat-based financial system.” Ouch.

Crypto ATMs have long caught the eye of regulators in the US and UK including the Financial Conduct Authority, which earlier this year pursued its “continued crackdown on this illicit sector” by shutting a bunch of them down.

Though the number of ATMs has dropped since 2022 highs, new machines are still being installed. As of October this year, 32,521 crypto ATMs exist globally, with the number rising since the summer, according to data provider AltIndex.

Shitcoins Club says on its website:

We are opposed to the fractional reserve banking and the participation of banks in the ever-increasing fiat money supply. As anarcho-capitalists, we despise what is commonly understood by the financial system. Our contempt goes far – reaching even the bank staff.

This anti-banking, stick-it-to-the-man philosophy might take some people back to the early days of crypto, when traders saw blockchain money as a revolution and an escape from the tight grip of major banks on global finance. It hasn’t quite worked out that way. Nevertheless, the crypto ATM crowd purports to remain steadfast in their beliefs.

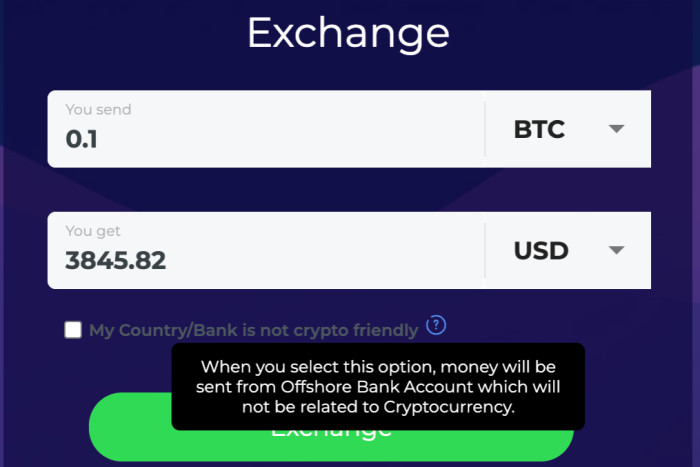

Sometimes they don’t even need the cash machine. Luxembourg-based Bitgamo runs a virtual crypto ATM where users can convert tokens to cash in the click of a few online buttons. No KYC, AML or registration required, the website boasts. And if you live in a country where regulators don’t like crypto? Simply tick the box and Bitgamo helpfully says “money will be sent from Offshore Bank Account which will not be related to Cryptocurrency.”

Forget decentralisation, distributed ledger technologies and other shiny words, let’s stick to good old-fashioned offshore accounting to evade laws and possibly also sanctions!

Gabriel Weber, director of communications at Bitgamo, was refreshingly forthright about his company’s approach: “The law here in Luxembourg is a bit different than other countries. We’re not forced by the authorities to request KYC from the client.”

And if the cash being converted to crypto comes from drug trafficking, people smuggling or arms dealing?

“We are not here to investigate, it’s not our job, our job is to exchange. As long as there isn’t a court order we cannot cooperate with any authorities,” Weber said.

And that anti-banking philosophy again: “What Satoshi [thought] when he created bitcoin is no longer what happens today. Crypto is about privacy, we support Satoshi’s idea. We are focusing to support privacy.”

Bitgamo plans to launch about 90 physical ATMs next year, Weber said, adding that business is booming, with more than 50mn daily transactions. And that so-called crypto winter? Please. “We are still hiring, we are expanding.”

Further reading:

— The rise of crypto laundries: how criminals cash out of bitcoin (FT)