- Tesla’s renewed Bitcoin accumulation, increasing its holdings to 11,509 BTC, signals growing corporate confidence in cryptocurrency as a strategic asset.

- Speculation abounds as Tesla’s actions spark debate, potentially influencing other institutional investors’ strategies towards Bitcoin amid rising interest in ETFs.

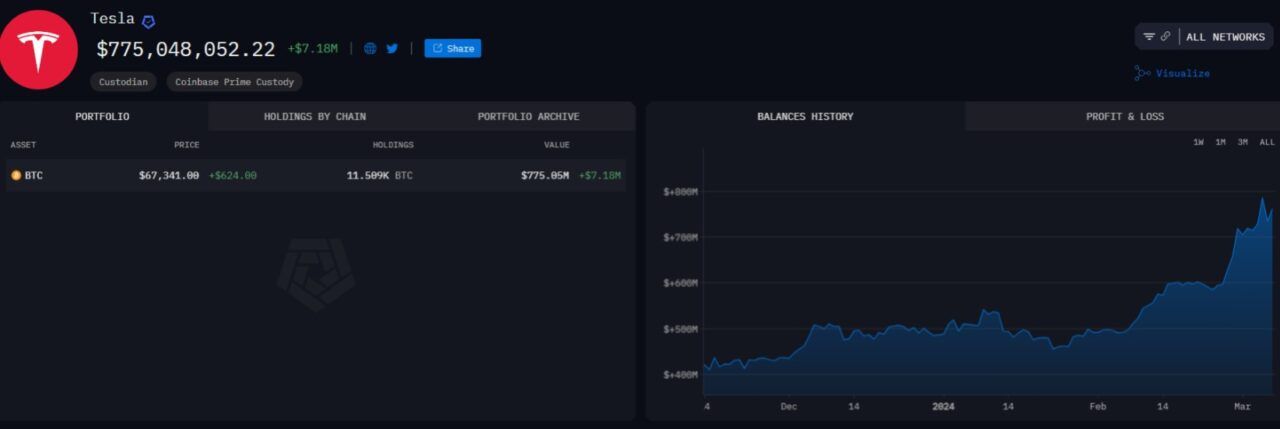

For Bitcoin, Tesla’s recent activities signal a potentially influential endorsement and renewed interest from one of the world’s most prominent electric car manufacturers. The acquisition of additional Bitcoin, increasing Tesla’s holdings from 9,720 BTC to 11,509 BTC as per Arkham Intelligence data, underscores a significant shift or reaffirmation in Tesla’s investment strategy regarding the flagship cryptocurrency.

This move comes after a period of reduction in Tesla’s Bitcoin portfolio in 2022, where it sold a substantial portion of its holdings.

Tesla’s fluctuating relationship with Bitcoin, including the initial purchase of $1.5 billion worth of BTC, selling about 10% of it, and later disposing of approximately 75% of its remaining Bitcoin in Q2 2022, has been a rollercoaster.

The company’s decision to resume accumulating Bitcoin, indicated by an increase of 1,789 BTC (worth around $120.4 million), could have significant implications for the cryptocurrency’s market perception and value. It highlights a renewed confidence or strategic interest in Bitcoin as an asset, despite past concerns over environmental issues related to Bitcoin mining expressed by Tesla’s CEO, Elon Musk.

Arkham said it has identified Bitcoin addresses held by Tesla and SpaceX on-chain. Tesla currently holds 11,510 Bitcoins in 68 addresses, approximately $780 million; SpaceX holds 8,290 Bitcoins in 28 addresses, approximately $560 million. Tesla’s current profit on Bitcoin is $476…

— Wu Blockchain (@WuBlockchain) March 7, 2024

The speculation within the crypto community, particularly on the microblogging platform X (formerly Twitter), regarding whether Tesla has restarted its Bitcoin purchases or if the observed increase is merely an accounting discrepancy, adds to the intrigue and potential market impact of Tesla’s actions.

If Tesla is indeed actively purchasing Bitcoin again, this could be reflected in future financial disclosures and might influence other institutional investors’ views and actions towards Bitcoin, especially at a time when spot Bitcoin ETFs are drawing institutional attention.

Moreover, Tesla’s involvement in Bitcoin, alongside SpaceX’s Bitcoin holdings, encouraged by Michael Saylor of MicroStrategy, aligns with a broader narrative of significant institutional engagement with Bitcoin.

With MicroStrategy holding 193,000 BTC, making it the world’s largest institutional holder of Bitcoin, Tesla’s renewed accumulation could reinforce Bitcoin’s standing in the financial ecosystem and potentially catalyze further institutional adoption.