The stagnation of the Bitcoin price despite the first rate cut by the US Federal Reserve since 2020 has perplexed many investors and traders within the market. In a new post on X, Andrew Kang, CEO of Mechanism Capital addressed the disproportionate emphasis that market participants have placed on Federal Reserve rate cuts and economic stimulus in China.

Why Is Bitcoin Stagnating?

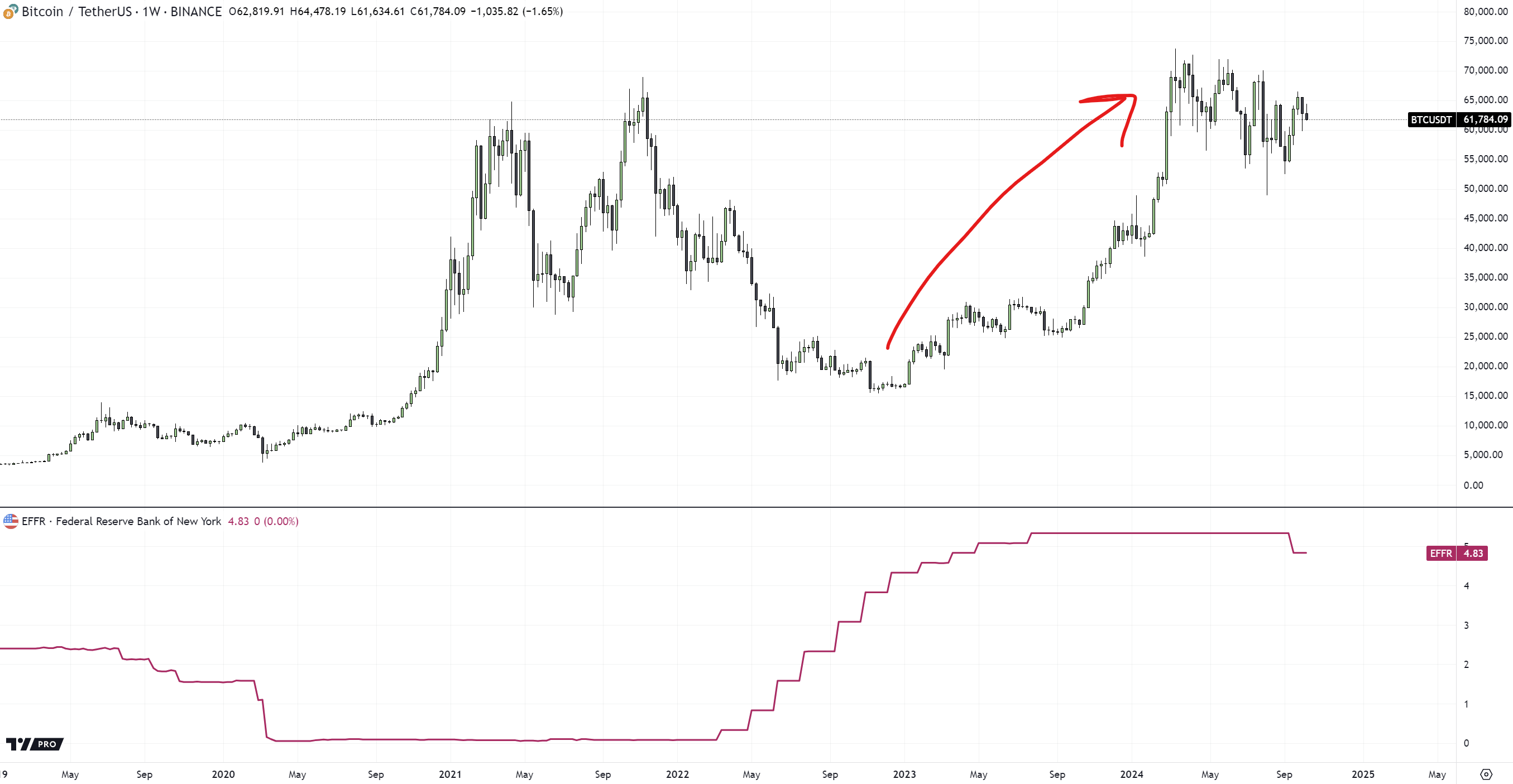

Kang challenges the prevalent market belief that interest rate cuts by the Federal Reserve will significantly boost Bitcoin and crypto prices. “Fed rates are only one of the factors that impact global liquidity, and global liquidity itself is only one of the factors that influence crypto prices,” he stated. Kang finds it “nonsensical to see BTC rally 4.5x during a period where rates were going to and at multi-decade highs—showing little correlation between rates and BTC—and then expect a strong inverse correlation to present itself as soon as rates start going down.”

Related Reading

He acknowledges that some argue future rate changes are already priced into the market but counters that this logic should apply equally to rate hikes and cuts. “This is not to say that rates are not important, but rather that they are well overweighted by most market participants,” Kang added. He notes that equities have a stronger tie to interest rates due to factors like discount rates used in valuing cash flows and mature corporate debt markets used to finance growth.

Addressing China’s recent economic stimulus, Kang observes that its impact on Bitcoin and crypto is even less significant than many believe. “It’s not surprising to see that the people extrapolating China stimulus as being extremely bullish for crypto are primarily non-Chinese,” he commented. According to Kang, those within China have noted a shift from crypto investments to A-shares in the stock market.

Supporting his claim with data, Kang pointed out, “Since Chinese stimulus was announced, USDT has traded to a discount to CNY. Still at 3% as of recent.” This suggests a decreased demand for the premier stablecoin Tether (USDT) in China, aligning with a move towards traditional equities.

Despite his critiques, Kang clarifies that he is not bearish on Bitcoin. “I just think that some people have gotten over their skis a little,” he remarked. Kang anticipates Bitcoin trading within a range of $50,000 to $72,000 until a significant new catalyst emerges.

Related Reading

However, he remains optimistic about opportunities within the market, stating, “The constant rotation of capital and new projects being developed means there will still be coins to buy to generate returns as a bull.” Nonetheless, Kang warns of potential volatility due to leveraged positions: “The market will still be prone to smaller corrections if leverage gets too high (decently high right now).”

Engaging with the community, X user Jakubko (@erkousti) suggested that Bitcoin’s 2023 price increase is more connected to anticipation of an ETF launch than interest rates. Kang concurred, responding, “That’s exactly my point. Interest rates are only a small piece of the puzzle. Even though they were negative for BTC, other factors like the ETF were able to drive BTC price higher. Other factors could drive it higher or lower here. We are not guaranteed infinity prices just because of rate cuts.”

Echoing this sentiment, crypto analyst Astronomer (@astronomer_zero) commented, “I believe interest rates (and yield inversion) only have a negligible impact on price. They are rather a holistic metric important for bond market players. But the zero-effect on stocks or crypto is proven already.”

Another analyst, Res (@resdegen), highlighted the correlation between Bitcoin and monetary supply: “BTC is more correlated to the quantity of money than interest rates. It started to rise as the RRP decreased, which ended up in net positive liquidity, regardless of interest rates, which were indeed close to the top.”

At press time, BTC traded at $60,903.

Featured image created with DALL.E, chart from TradingView.com